Explain How Opportunity Cost Differs From Accounting Cost

Opportunity costs are the benefits you could have received if you had chosen one course of action but that you. Incremental costs and Sunk costs.

How To Stop Making Foolish Money Decisions Personal Finance Opportunity Cost Personal Finance Books

The profit or whereas economic profit is the value of cash flow thats generated above all other opportunity costs Opportunity.

. But opportunity cost OC is an implicit cost which is the benefit foregone by choosing one alternative over an. Accounting costs refer to the costs recorded in. Costs are important feature of many business decisions.

The difference between the monetary value of her time and the monetary amount that her time would have been worth in its next best use. For the purpose of decision making costs are usually classified as differential cost opportunity cost and sunk cost. In order to understand the general concept of costs it is important to know the following types of costs.

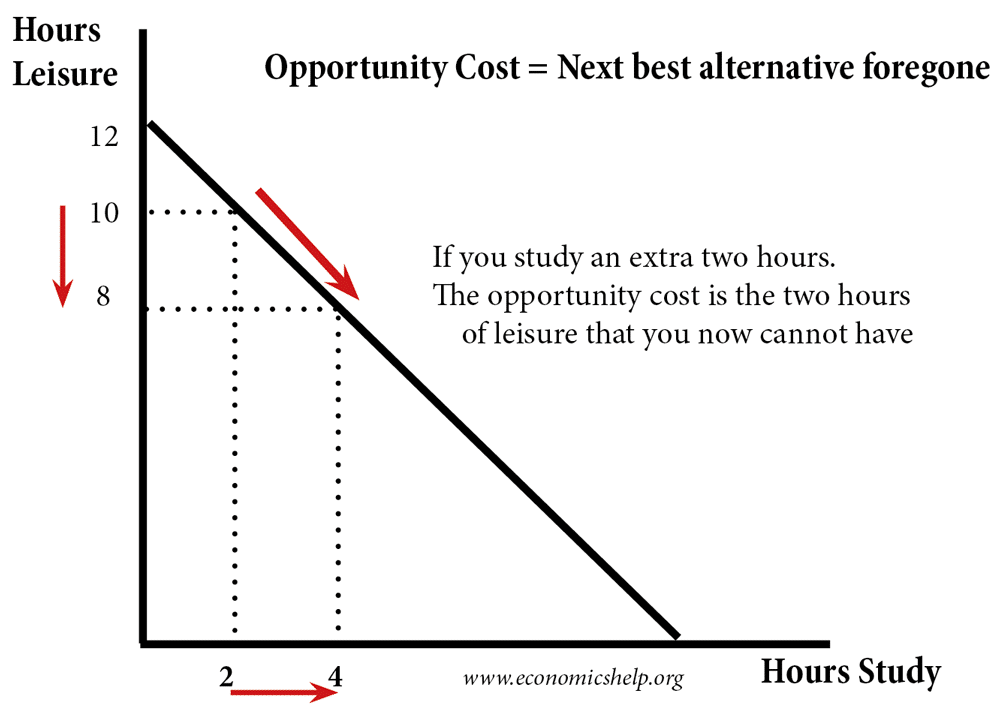

The opportunity cost of any decision is what is given up as a result of that decision. The only difference is that the concept of opportunity cost in accounting gives more focus on the calculation or quantitative part. The concept is somewhat the same in economics as well as accounting.

What are Economic Costs. Unlike other types of cost opportunity cost does not require the payment of cash or its equivalent. Despite all the complexities cost accounting can largely be broken into fixed and variable costs.

If the marginal cost of. Direct indirect fixed and variable are the 4 main kinds of cost. In simpler terms accounting cost is the overall cost of anything your business has paid for.

Opportunity cost is an implicit cost as it does not result in any actual cash outflow for the entity. Opportunity costs sums up the total cost for that trade off. Explain what condition must hold for a firm to minimize its production cost.

These costs are relevant for the economists because the costs of wages and materials represent money that could have been usefully spent elsewhere. It however may find its way into management reports that reflect the rationale for management decision making. It is essential to have a firm grasp of the concepts differential cost differential revenue opportunity cost and sunk cost.

Economic costs also known as opportunity costs look at the potential difference between taking one action over another. What is Explicit Cost. What is the expansion path.

In addition to this you might also want to look into operating costs opportunity costs sunk costs and. Accounting costs are sometimes referred to as hard costs They are easily tracked and include dollar amounts spent in typical areas such as payroll equipment production and leases. For example You have a job in a company that pays you 25000 per year.

Trade offs happen in decision making when one option is chosen over another option. Opportunity cost is defined as the worth of a missed alternative opportunity in accounting also. False because accounting costs include opportunity costs such as the value of the business owners time.

The firms economic profits are calculated using opportunity costs. The opportunity cost of the owners accounting work is A. For example if the company is paying 1000 per.

Accounting profits are calculated using only explicit costs. Accounting cost like accounting profit follows the basic principles of accounting 101. Accounting profit is a companys net earnings on its income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time.

It is thus not accounted for nor does it reflect in any financial statements. Economic costs include accounting costs but they also include opportunity costs. Accounting costs and Economic costs.

3 rows Accounting Cost. What is the difference between the opportunity cost and the accounting cost. A pool of activity costs associated with particular processes and used in activity-based costing ABC systems.

These two definitions of cost are important for distinguishing between two conceptions of profit accounting profit and economic profit. A Accounting cost is the actual costs incurred in course of running a business for example materials labor cost and overhead expenses. What is the opportunity cost.

Let us look at how economic costs can differ from accounting costs in the treatment. Opportunity cost includes both explicit costs and implicit costs. DirectTraceable costs and IndirectUntraceable costs.

Opportunity cost can be considered while making decisions but its most accurate when comparing decisions that have already been made. It means total revenue minus explicit coststhe difference between dollars brought in and dollars paid out. Types of Opportunity Cost in Production.

Explain the difference between economies of scale and economies of scope. It is a potential benefit or income that is given up as a result of selecting an alternative over another. Opportunity cost measures the impact of making one economic choice instead of another.

Economic profit is total revenue minus total cost including. Opportunity costs can be viewed as a trade off. Explicit costs are the cost which includes the monetary payment from the producers.

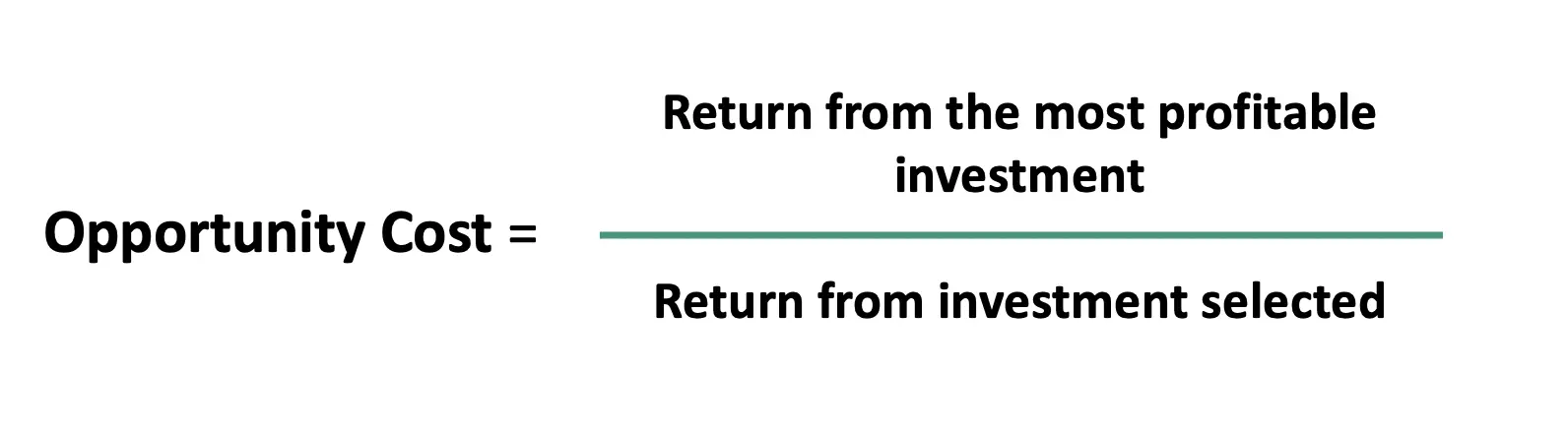

Opportunity cost is how much less return of investment a company received because of investing capital somewhere else. The other costs can be fit into either the fixed or variable categories. Therefore accounting profits are higher than economic profits.

From an investor perspective opportunity cost will always mean that the investment choices made will be carrying immediate loss or gain in the future. Costs can be classified for decision making. For example wages are the opportunity costs for labour inputs purchased in a competitive market.

Accounting profit is a cash concept. Private costs and Social costs. Explicit costs involve opportunity cost as well.

While its often used by investors opportunity cost can apply to any decision-making process. Fixed costs and Variable costs. Why can one be present without the.

Outlay costs and Opportunity costs.

Concept Of Cost Management Guru Managerial Economics Economics Teaching Economics

Advantages And Disadvantages Of Profitability Index Financial Life Hacks Learn Accounting Finance Investing

Pin By Fernando On Financiero Business Management Financial Accounting Management

Accounting Profit Vs Economic Profit All You Need To Know In 2021 Learn Economics Accounting Principles Accounting

5 Types Of Financial Statements Balance Sheet Income Cash Flow 2 Financial Statement Accounting And Finance Financial

Optimal Decision Making And Opportunity Costs Video Khan Academy

How To Graph And Read The Production Possibilities Frontier Economics Lessons Economics Lessons College Teaching Economics

Cost Of Capital Cost Of Capital Opportunity Cost Financial Management

Cost Of Production Money Real And Opportunity Costs

Difference Between Opportunity Cost And Trade Off

Opportunity Cost Formula Example Analysis Accountinguide

Difference Between Cost Accounting Workforce Business Process Management

Opportunity Cost Meaning Importance Calculation And More

Difference Between Accounting And Economic Profit With Table Quantitative Research Quantitative Research Infographic Psychology Research

Comments

Post a Comment